Financing Cost of Local Government Financing Vehicle Bond and Risk Contagion: Based on the Perspective of Non-Standard Financing Default [in Chinese]

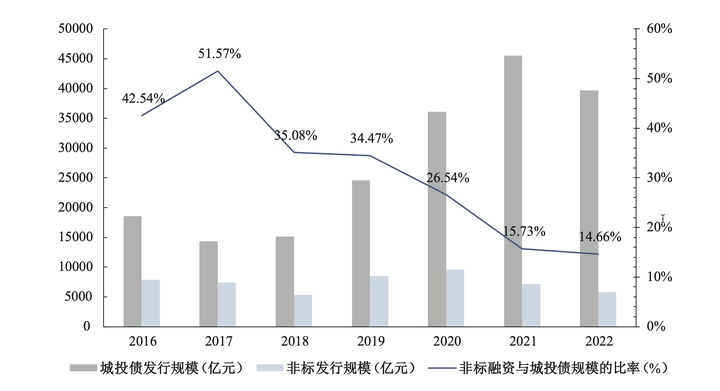

Abstract: In recent years, the frequent occurrence of non-standard defaults of local government financing vehicle (LGFV) has aggravated the risk of local government implicit debt. Based on the bond issuance, non-standard default events of LGFVs and local economic and fiscal data from January 2018 to September 2023, this paper systematically discusses the impact of non-standard default events on the financing costs of LGFVs and the potential risk contagion effects among regions.

The results show that the occurrence of non-standard default events of LGFVs will transmit risk-disclosure signals to the market, resulting in higher financing costs in the LGFV’s bond market. In addition, the non-standard default risk has a significant contagion effect within the cities, and its intensity shows a time-attenuation characteristic; however, the contagion effect between cities is not obvious. Heterogeneity analysis shows that higher-rating, higher-administrative-level and main LGFVs are more strongly affected by contagion effects induced by non-standard default. The above results are still valid after a series of robustness tests and the exclusion of common factors.

The findings of this paper reveal the negative impact of non-standard default on local government implicit debt, which is of great significance for the central government to comprehensively identify and resolve risk factors and establish a long-term mechanism to prevent and resolve local debt risks.

近年来城投公司非标违约事件频发,加剧了地方隐性债务市场的风险。文章基于2018年1月—2023年9月中国城投公司的债券发行、非标违约事件及地方经济财政数据,深入探讨了非标违约事件对城投公司融资成本的影响,以及其在区域间潜在的风险传染效应。结果表明,城投公司发生非标违约事件会向市场传递风险信号,导致其在城投债市场上面临更高的融资成本。此外,非标违约风险在“城市内”存在显著的传染效应,且其强度呈现出随时间衰减的特征;但在“城市间”的传染效应并不明显。异质性分析显示,更高评级、更高行政等级以及作为地方主要融资平台的城投公司受到的非标违约传染效应更强。以上结果在经过一系列稳健性检验和排除共同因素影响后仍然成立。文章的发现揭示了非标违约对地方政府隐性债务的负面影响,对于中央政府全面甄别并化解风险因子、建立防范化解地方债务风险的长效机制具有重要意义。

作者简介

焦玮琳(2001−),女,山东菏泽人,上海交通大学安泰经济与管理学院博士研究生

郑维伟(1997−),男,重庆人,上海交通大学安泰经济与管理学院博士研究生

郑旭(1963−)(通讯作者),男,安徽淮南人,上海交通大学安泰经济与管理学院教授,博士生导师